![How To Find a $200 or $300 Bonus Offer for Chase’s Savings Account [2023]](https://upgradedpoints.com/wp-content/uploads/2017/10/shutterstock_459678514.jpg?auto=webp&disable=upscale&width=1200)

Boasting a portfolio of over 20 cards, Jarrod has been an expert in the points and miles space for over 6 years. He earns and redeems over 1 million points per year and his work has been featured in o.

Updated: July 24, 2023, 8:09am CDT43 Published Articles 3380 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

With years of experience in corporate marketing and as the executive director of the American Chamber of Commerce in Qatar, Keri is now editor-in-chief at UP, overseeing daily content operations and r.

Director of Operations & Compliance

6 Published Articles 1203 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Kellie’s professional experience has led her to a deep passion for compliance, data reporting, and process improvement. Kellie’s learned the ins and outs of the points and miles world and leads UP’s c.

![How To Find a $200 or $300 Bonus Offer for Chase’s Savings Account [2023]](https://upgradedpoints.com/wp-content/uploads/2017/10/shutterstock_459678514.jpg?auto=webp&disable=upscale&width=1200)

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

JPMorgan Chase is the largest bank in the U.S. with over $3 trillion in assets under management, over 4,700 retail branches, and 16,000 ATMs worldwide. With numbers like that, it is no wonder so many people choose Chase for their banking needs.

Chase offers just about every type of banking, lending, and investment product you can think of, including general savings accounts. Fortunately, if you’re in the market for a new savings account, Chase periodically runs promotions where it offers a welcome bonus to new account holders. In the past, we’ve seen Chase savings account bonuses of up to $300 — talk about a nice way to boost your savings balance!

So how can you earn a welcome bonus offer for a Chase savings account? This guide will help show you how to do just that!

Chase offers 2 standard savings accounts products — Chase Savings and Chase Premier Savings. The benefits between the 2 accounts are largely the same, but the Chase Premier Savings account offers a better interest rate on your funds.

Here are some of the benefits you’ll receive regardless of which account you choose:

Hot Tip: For more details on Chase savings accounts, view our ultimate guide to Chase savings accounts.

If you feel that a Chase savings account is a good fit for your needs, here are some steps you can take to locate a welcome bonus offer prior to signing up.

Every so often, Chase runs public promotional offers on its savings accounts that are available to anyone who decides to open a savings account while the promotion is running. So if you’re considering opening a Chase savings account, doing so when you can earn a bonus of up to $300 is the perfect time to do so!

Did you know that the snail mail you receive can actually make you money? It’s true! In fact, Chase regularly sends out targeted promotional offers for its banking and credit card products that can even be better than the public offers you see on the standard Chase website. So before dumping all of that mail in the trash or deleting it from your email inbox, take a second before doing so to see if the offer is worthwhile to you!

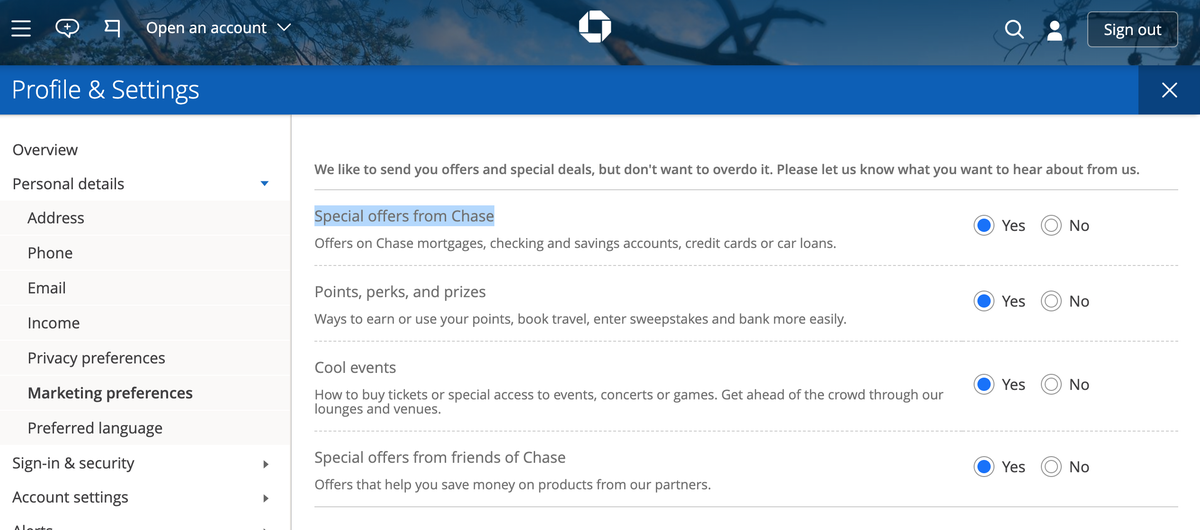

If you’re someone who never receives promotional offers from Chase either via email or your home mailbox, then the likely culprit is that you have not given the bank permission to send you special offers. How you can change this? It is simple — start by going to the Chase website and log into your Chase account, then click Profile, then Settings. Once there you’ll want to click Marketing Preferences and then click Yes to receive special offers from Chase.

Do you have a friend or family member that banks with Chase? If so, you should check to see if their referral offer is as good or better than the current public offer. If it is, then you and your friend will both earn some extra cash after you sign-up for an account. Likewise, once you’ve created a Chase account, you can start sending your own referrals out and earn extra cash for each person who uses your code.

If you’re hoping to be targeted for a promotional sign-up offer, but you haven’t opted-in to marketing offers, you’re likely going to be waiting for a pretty long time. Put simply, Chase is not permitted to contact you about special offers unless you give it permission to do so. So make sure you opt-in for your account under Marketing Preferences to stay in the know!

Pretty straightforward here, but if you already have a Chase savings account, or have had one within the last 6 months, then you will not be eligible for a new welcome bonus offer.

Everyone needs a savings account, whether you’re building up a rainy day fund, saving for a house or car, or anything in between. If you feel that the savings accounts offered by Chase are a good fit for you and your needs, then you might as well earn yourself some extra cash when signing up, and if you follow the tips in this article, you might be able to do just that!

The information regarding Chase Savings℠ and Chase Premier Savings℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Featured Image Credit: Tooykrub via ShutterstockOpening a Chase savings account is simple and can either be done online through the Chase website or in your local Chase retail branch.

To close a Chase savings account you can either visit your local Chase branch, contact customer service 800-935-9935, or send Chase a secure message through your online account portal.

Usually, you will receive the welcome bonus for your Chase savings account about 15 days after you have completed any sign-up or deposit requirements, though it may take longer in some instances. If you’ve completed the bonus requirements and more than 15 days have passed, you can contact the Chase customer service line at 800-935-9935 to check on the status.

Your savings account must remain open for at least 6 months or Chase will revoke the bonus at closing as an early account termination fee.

Yes, both the Chase Savings and Chase Premier Savings accounts charge fees, but you can get these fees waived by maintaining a minimum balance or completing other requirements.

For example, the $5 monthly Chase Savings fee can be waived by maintaining a daily balance of $300 or having your account linked to an eligible Chase checking account. The $25 monthly Chase Premier Savings fee can be waived by maintaining a daily balance of $15,000 or by linking the account to a Chase Premier Plus or a Chase Sapphire Checking account.

Was this page helpful?

Boasting a portfolio of over 20 cards, Jarrod has been an expert in the points and miles space for over 6 years. He earns and redeems over 1 million points per year and his work has been featured in outlets like The New York Times.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts.

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy. This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Top Partner Offers

Our Selection Approach

LIMITED TIME OFFER!

Earn $900 Cash Back

BEST LOUNGE ACCESS

Earn 80,000 Points

Top Partner Offers - Our Selection Approach

At Upgraded Points, our team has rigorously evaluated nearly every travel and rewards credit card available for both consumers and businesses. Our recommendations are based on direct experience: we endorse cards that we’re currently using, cards we’ve used in the past and found valuable, or cards that we truly believe could offer real benefits to our readers.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Upgrade your travel experience

© 2024 Upgraded Points™, LLC. All Rights Reserved.

Disclaimer: Upgraded Points, LLC and its website, UpgradedPoints.com, provides information on credit cards, reward programs, travel information and ancillary information concerning travel and credit cards. The information provided is for informational purposes only and should not be considered financial, tax or legal advice.

Upgraded Points, LLC uses reasonable efforts to maintain accurate information on the site — and prior to applying for any credit card offers found on UpgradedPoints.com, all visitors should review other features of such credit cards including but not limited to interest rates, annual fees and transaction fees, and should determine the suitability of such credit cards considering their own individual financial position.

Advertiser Disclosure: Many of the credit card offers that appear on this site are from credit card companies from which we receive compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all credit card companies or all available credit card offers. For more information on our advertisers and how we make money, see our advertising policy here. In addition, as an Amazon Associate we earn from qualifying purchases.

Editorial Disclosure: The content featured on UpgradedPoints.com has not been influenced, provided, or reviewed by the credit card companies mentioned. Any and all options, reviews, comments and analyses are the responsibility of the author(s) and not any Advertiser or credit card issuer.